Adjustable-Rate Mortgages: Flexibility and Savings

Adjustable-rate mortgages (ARMs) offer homeowners a flexible option with lower initial interest rates compared to fixed-rate loans. These loans are ideal for buyers who plan to move or refinance before the rate adjusts, giving them the opportunity to save money in the short term. At Brian Sager Mortgage, we’re here to help you decide if an ARM is the right choice for your financial strategy.

Understanding Adjustable-Rate Mortgages

What is an Adjustable-Rate Mortgage?

An adjustable-rate mortgage (ARM) starts with a fixed interest rate for an initial period, followed by periodic rate adjustments based on market conditions. Key features include:

Lower Initial Rate: Enjoy lower payments during the fixed period, typically the first 5, 7, or 10 years.

Adjustments Based on Market Index: After the fixed period, the rate adjusts annually or semi-annually according to a specified index.

Caps for Protection: ARMs include limits on how much the rate can increase, providing some predictability.

Who Benefits Most from an ARM?

Adjustable-rate mortgages are a great option for:

Buyers planning to move or refinance within a few years.

Investors looking to reduce costs on short-term property holdings.

Borrowers seeking lower initial payments to manage their budget.

Advantages of Adjustable-Rate Mortgages

Lower Initial Payments: Save money during the fixed period, freeing up funds for other priorities.

Potential Savings if Rates Drop: If market rates decrease, your adjusted rate could be lower than expected.

Flexibility for Short-Term Goals: Ideal for buyers who don’t plan to stay in their home long-term.

Explore Adjustable-Rate Mortgages Today

An ARM could be the key to achieving your homeownership goals while saving money in the short term. Contact Brian Sager Mortgage to learn more about adjustable-rate loans and discover if this flexible option is the right fit for you.

How ARMs Work: The Fixed and Adjustment Periods

ARMs are structured in two main phases:

Fixed-Rate Period: The interest rate remains constant for the first 5, 7, or 10 years, depending on the loan. During this time, payments are predictable and often lower than a fixed-rate mortgage.

Adjustment Period: After the fixed term, the rate adjusts periodically based on the loan’s index and margin.

Adjustment caps limit how much the rate can increase:

Initial Cap: Restricts the first adjustment after the fixed period.

Subsequent Cap: Limits changes during each adjustment period.

Lifetime Cap: Sets a maximum for the rate over the life of the loan.

These protections ensure that ARMs remain manageable, even if rates rise significantly..

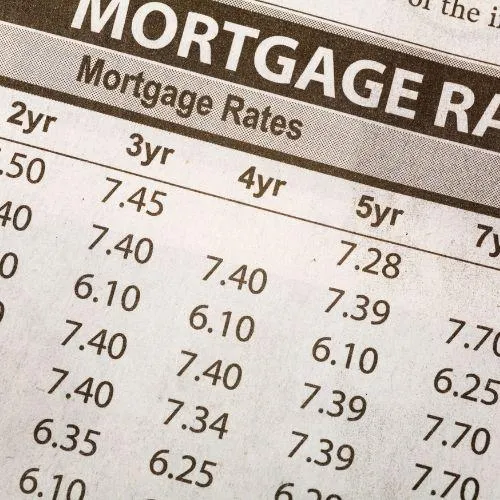

How Do ARMs Compare to Fixed-Rate Mortgages?

When deciding between an ARM and a fixed-rate loan, it’s essential to weigh the pros and cons of each:

Interest Rates:

ARMs: Lower initial rates that adjust over time.

Fixed-Rate Mortgages: Stable rates throughout the loan term.

Monthly Payments:

ARMs: Smaller payments during the initial period, potentially increasing later.

Fixed-Rate Mortgages: Consistent payments for easier budgeting.

Best For:

ARMs: Buyers with short-term plans, such as moving or refinancing.

Fixed-Rate Mortgages: Buyers seeking long-term stability.

We’ll help you evaluate your goals and financial plans to decide which option works best.

Is an ARM Right for You?

Consider an ARM if:

You’re buying a starter home and plan to upgrade in a few years.

You’re confident you’ll refinance before the adjustment period begins.

You prefer lower initial payments to manage your finances.

At Brian Sager Mortgage, we’ll walk you through the risks and rewards of ARMs so you can make an informed choice.

Brian Sager Mortgage

Your trusted partner in home financing, serving Miami, Fort Lauderdale, Aventura, Bal Harbour, Hollywood, and beyond. Let us guide you through the mortgage process with expertise, transparency, and personalized service.

Navigation

Home

About Us

Services

Contact Us

Locations

Locations

Miami, FL

Fort Lauderdale, FL

Aventura, FL

Hollywood, FL

Bal Harbor, FL